Blog

-

Greenfield Cooperative Bank Announces Promotions

Tony Worden, Chief Executive Officer of Greenfield Cooperative Bank and it’s Northampton Cooperative Bank division, is pleased to announce a number of well-deserved promotions within the bank.

“We are excited to promote these employees to their new positions,” said Worden. “They are all valuable members of our team and have a proven track record of success.”

Read More about Greenfield Cooperative Bank Announces Promotions

-

FDIC and DIF Insurance Explained

As a member of both the Federal Deposit Insurance Corporation (FDIC) and the Depositors Insurance Fund (DIF), Greenfield Cooperative Bank and it's Northampton Co-op Bank Division provides full insurance for our customers’ deposits and accrued interest without limit or exception. Each depositor is insured by the FDIC to at least $250,000. All deposits above the FDIC insurance amount are insured by the Depositors Insurance Fund (DIF).

-

The Benefits of Attending a First Time Home Buying Webinar

By attending a First Time Home Buying Webinar you’ll have the opportunity to hear from real estate professionals - including attorneys, loan officers, realtors, home inspectors, and housing counselors. These professionals can give you a breakdown of the process so you’ll have a better understanding of what to expect.

Read More about The Benefits of Attending a First Time Home Buying Webinar

-

Mortgage Pre-Qualification or Pre-Approval: What's the Difference?

When you are looking for a home and do not have a specific property in mind, you can consider a pre-qualification or pre-approval.

Read More about Mortgage Pre-Qualification or Pre-Approval: What's the Difference?

-

The Benefits of Speaking With Your Local Commercial Lender Early

When either starting a new business or even looking for new financing for an existing business, it’s highly recommended that you sit down with a local commercial lender early in the process.

Read More about The Benefits of Speaking With Your Local Commercial Lender Early

-

Greenfield Cooperative Bank Helping Families Keep Warm This Winter

Tony Worden, President and CEO of Greenfield Cooperative Bank, recently announced that the Bank would be donating $30,000 to area organizations to help with fuel assistance.

Read More about Greenfield Cooperative Bank Helping Families Keep Warm This Winter

-

3 Reasons You Should Be Using a Mobile Banking App

While online and mobile banking certainly aren’t new, in the past few years they have become increasingly important. For those times when you are unable to get to the bank, using a mobile app can be especially convenient.

Read More about 3 Reasons You Should Be Using a Mobile Banking App

-

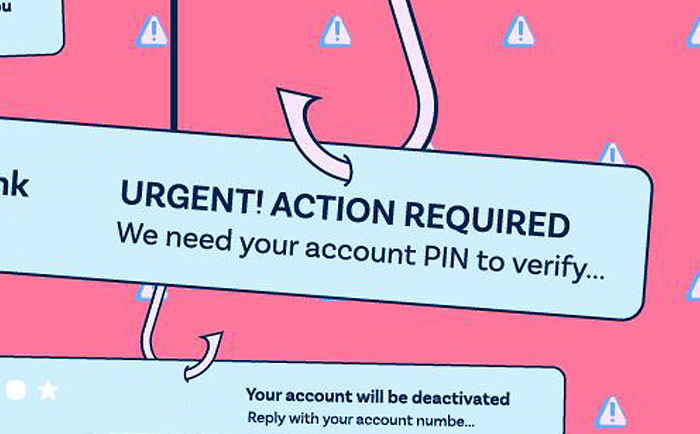

Can You Spot a Phishing Scam?

Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be their bank. And in this time of expanded use of online and mobile banking, the problem is only growing worse. In fact, the Federal Trade Commission’s report on fraud estimates that American consumers lost a staggering $8.8 billion to phishing scams and other fraud in 2022—an increase of 44% over 2021.

-

The Benefits of Obtaining a Mortgage Prequalification

When searching for a new home an important first step is getting prequalified for a mortgage loan. Lenders often highly recommend obtaining one due to the number of benefits it provides the homebuyer.

Read More about The Benefits of Obtaining a Mortgage Prequalification

-

Greenfield Co-op Remains Committed to Local Communities

Greenfield Co-op Remains Committed to Local Communities, as One of the Top 3 Purchasers of State House Notes.

Read More about Greenfield Co-op Remains Committed to Local Communities